¿Mudarme a Miami es una buena decisión financiera?

25 de May de 2023

¿Cómo dejar de gastar más que Jeff Bezos?

23 de June de 2023Is moving to Miami a sound financial decision? We see that Florida, specifically Miami, continues to receive a large flow of people.

We are seeing that Florida, specifically the city of Miami, continues to receive a large flow of people. Which are moving to this new destination, motivated mainly by its tropical charms.

On the other hand, we hear how its inhabitants point out daily that it is becoming a very expensive area to live in. Some people say that only the mega-rich can live in Miami, saying that it is like living in Monaco.

In this article, we will analyze from a financial point of view how convenient it is to live in Miami. Leaving aside its beautiful beaches, climate, hurricanes, educational system, and crocodiles.

.

Florida’s Growth Boom – Welcome to Miami!

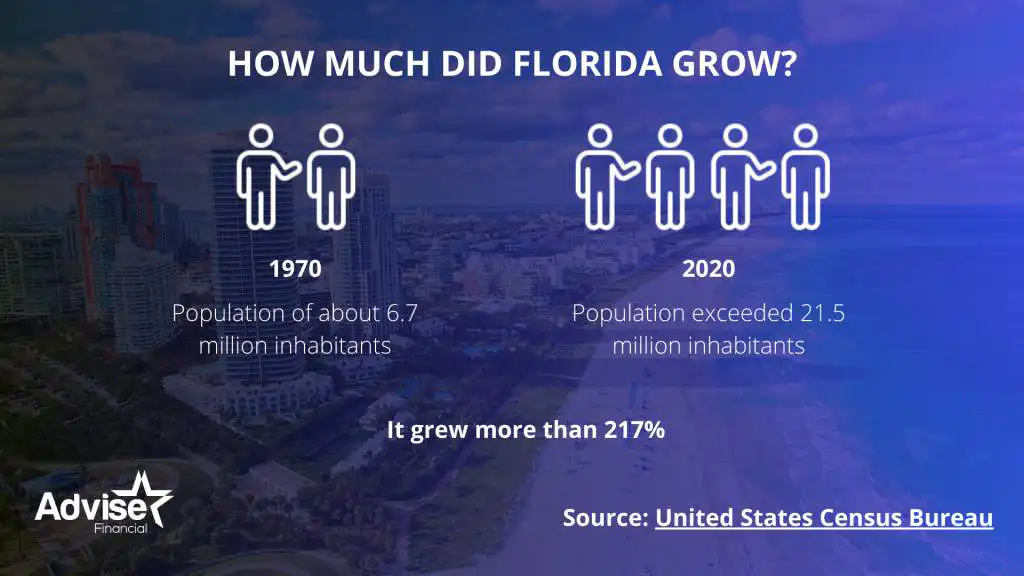

According to the United States Census Bureau, in the 1970s, Florida had a population of about 6.7 million. But by the year 2020, that figure exceeded 21.5 million inhabitants, representing a growth of more than 217%.

.

.

During the years 2012 and 2022, few cities received such a strong migration of millionaires, Miami being one of them, with a growth of 70%, according to a study published in Yahoo Finance.

By 2022, Florida continued to grow in billionaires, who moved from New York, California, and other states, reaching that figure of about 78 billionaires, among which are:

- Ken Griffin, CEO of Citadel with a fortune of $31.6 billion, resides in Miami.

- Thomas Peterffy, CEO of Interactive Brokers with $24 billion.

- David Tepper, CEO of Appaloosa Management, with $18 billion.

- Carl Icahn, CEO of Icahn Enterprises, with $17 billion.

- Shahid Khan, CEO of Flex-N-Gate with $11 billion.

By the way, the first 4 are dedicated to the investment area.

.

Who moved to Miami?

It wasn’t just the mega-millionaires who moved; Rather, during 2019 and 2020, more than 20,000 families with incomes of more than $200,000 a year moved, according to Smartasset.

If you’re wondering what was one of the main reasons these millionaires and high-income earners moved to Florida, The answer is very simple: taxes.

.

Nine states in the country do not charge income tax at the state level, some of them Florida, Texas, Tennessee, and Nevada.

And according to Billionaire Stephen Ross, this moving process from New York to Florida is going to keep happening. People will prefer to pay fewer taxes. It is no longer just those who are retiring who are thinking of moving to Miami, as was traditionally the case. Every day, more young people with good incomes are looking to escape from cities like New York.

.

Having so many millionaires nearby makes homes go up in value

Guess which is the city that wins in the ranking of where millionaires want to have a second home?

According to a report published on CNBC Make It, Miami is followed in second place by The Hamptons, which has always been the preferred destination for millionaires and now sees itself dethroned by Miami.

It is estimated that in Miami, there are some 38,000 millionaires. Within the list of the 10 cities in the USA where millionaires buy to have a second home, Florida occupies 3 positions.

.

.

And the neighborhoods are changing; the best example is Miami Star Island, where stars like Shaquille O’Neal and Rosie O’Donnell live. Their houses went from worth an average of $23.5 million in 2019 to $40 million in 2023 after billionaire Ken Griffin moved to the area. Their neighbors, on average, have about twenty million reasons to thank them for their arrival. Source: WealthManagement.com

Of course, you will not think that Mr. Griffin bought a $40 million house but that he bought 5 properties totaling about $194 million. If you have a fortune of 31 billion, buying 194 million homes is less than 0.6% of your assets. In other words, it was not so expensive for his levels.

.

Rising prices on Miami Beach homes

5 Miami Beach neighborhoods, including Palm Island, San Marino Island, Rivo Alto Island, Hibiscus Island, and Di Lido Island, had an increase in the prices of their homes in 2 years of at least 61%. In the worst case, being able to reach a rise of up to 85%.

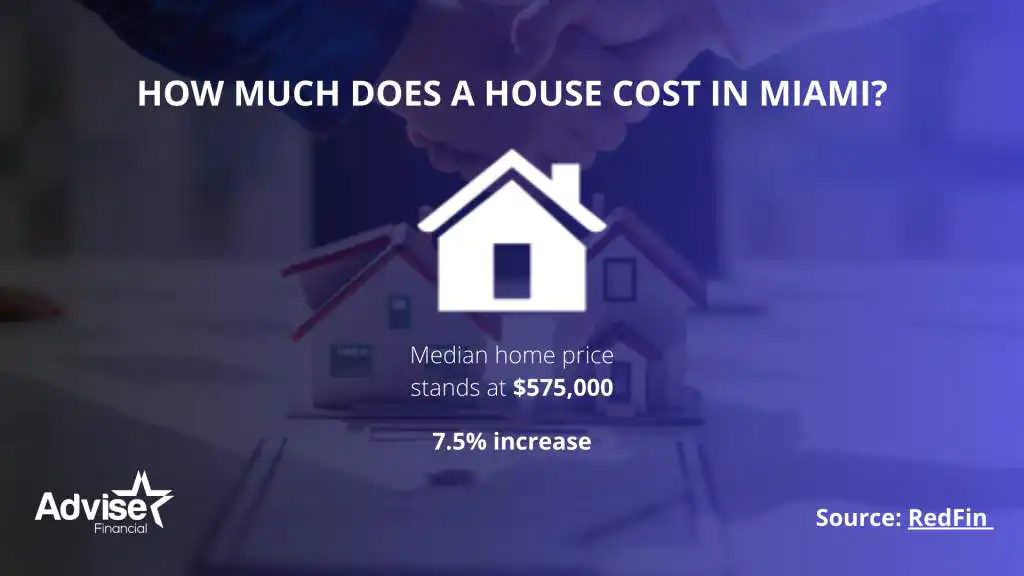

It didn’t just happen as well as the mega-rich; in many states, the price of homes has been falling as a result of the rise in mortgage interest rates. In Miami, according to RedFin, the average price of a home stands at $575,000, which represents an increase of 7.5%.

.

.

But unlike the rich, the number of houses sold during the year 2023 has been falling compared to last year. And while in 2022, houses were sold in 49 days on average. Now they are sold after 66 days, which shows us that reality is not the same for everyone.

Note: these comments do not represent any type of advice on the real estate market. Always remember to contact a specialist in said markets.

.

Inflation, unemployment levels, and jobs

A few years ago, Miami began to be called the new capital of technology, and some say it will be the new Silicon Valley of the East Coast.

According to information from business.com, Florida was the preferred destination for the formation of new companies. Of the 5.8 million company applications made from January 2021 to January 2022 across the United States, 12% of the cases were in Florida.

.

.

Some of the most recognized names have been the following:

- Citadel and Citadel Securities, which is Ken Griffin’s company.

- Blackstone Real Estate Investment Group.

- The investment bank, Goldman Sachs and

- Autonomous vehicle company Argo AI.

.

Not all that glitters is gold:

When consulting the Inflation Index for the Miami area, its annual growth was 9.3% as of February 2023. While the growth of prices for an average city in the USA was 6% for the same period. US Source Bureau of Labor Statistics.

- The average income of families in Miami-Dade County had been increasing until the year 2020. A decline begins to show for 2021. Source: Federal Reserve Bank of St. Louis.

- While the national poverty level for 2021 was 11.6%, in Miami-Dade County, it was 15.2%, according to census.gov

- On the other hand, unemployment remains at extremely low levels. While the unemployment rate as of March 2023 in the USA was 3.6%; in the Miami area, this rate stands at 2.2%.

.

In conclusion, is moving to Miami a good decision?

Undoubtedly, Miami and the state of Florida have a great fiscal advantage that attracts both millionaires and high-income professionals. Still, it can be seen that the reality is not going to be the same for everyone, given that housing prices could continue to rise. For those people who do not have a very good income, the cost of living can become increasingly expensive.

Of course, what you can be sure of is that with so many millionaires, the businesses that serve this segment of the population will become increasingly exclusive. Many retirees may have to look for another retirement plan than the sunny beaches of South Florida. In order to ensure that your savings and investment portfolios can last longer over time.

9 Comments

Excellent read, I just passed this onto a friend who was doing a little research on that. And he actually bought me lunch as I found it for him smile Thus let me rephrase that: Thank you for lunch! “Too much sanity may be madness. And maddest of all, to see life as it is and not as it should be” by Miguel de Cervantes.

he blog was how do i say it… relevant, finally something that helped me. Thanks

I am typically to running a blog and i really appreciate your content. The article has actually peaks my interest. I’m going to bookmark your web site and keep checking for brand spanking new information.

magnificent post, very informative. I ponder why the other experts of this sector do not notice this. You must proceed your writing. I’m sure, you have a huge readers’ base already!

Hi there! This post couldn’t be written any better! Reading through this post reminds me of my previous room mate! He always kept talking about this. I will forward this article to him. Pretty sure he will have a good read. Thank you for sharing!

Greetings from Los angeles! I’m bored at work so I decided to check out your blog on my iphone during lunch break. I really like the knowledge you provide here and can’t wait to take a look when I get home. I’m surprised at how quick your blog loaded on my cell phone .. I’m not even using WIFI, just 3G .. Anyhow, wonderful site!

Magnificent web site. Lots of useful info here. I’m sending it to some friends ans also sharing in delicious. And of course, thanks for your sweat!

Hi , I do believe this is an excellent blog. I stumbled upon it on Yahoo , i will come back once again. Money and freedom is the best way to change, may you be rich and help other people.

Yeah bookmaking this wasn’t a bad decision great post! .