¿Estás preocupado por los impuestos en tu jubilación? Aquí te explicamos cómo planificar un futuro fiscalmente eficiente.

05/30/2024

Palm Beach – Florida Retirement: Do you know what your dream retirement looks like? And why is it important?

06/14/2024Unsure of Your Retirement Tax Bill? Here’s How to Plan for a Tax-Efficient Future

Whether you are preparing for retirement or you are already retired. This article will discuss the different fundamental aspects that you should know to optimize your retirement by being tax efficient. We must always pay the amount that corresponds to us in taxes, but perhaps many leave the IRS a tip that is not necessary.

Indeed, during all these years, you have been contributing to your taxes, paying for your Social Security. And saving in the different retirement plans with tax benefits.

Some of you may think that being already retired. And without income from work means paying much lower taxes. And this happens in most cases.

But there are also some cases where people pay more taxes when they are retired than in their best years of income at work.

We are going to present the most common questions we receive from our Hourly Financial Planning clients. So that you can take action today and achieve a better retirement. Knowing what factors could correct and avoid costly mistakes:

1.- If I ask for my Social Security check before age 67 and continue working, there is no problem, right?

According to a study conducted by Paycheck: “1 in 6 retirees is thinking about returning to work”. And the two main reasons are:

a) They need the money and

b) They are bored with retirement.

Now, whatever the cause, many might think that it is an excellent decision because in addition to receiving the Social Security check. They will receive another payment for their work. And in this way, they will have the amount they need to be able to pay their daily expenses.

If you reach your full retirement age, which in many cases is 67 years old (those born after 1960). Then it is true that you will receive your full Social Security check.

But if you start requesting this benefit before reaching your Full Retirement Age, you should keep in mind that your check could be smaller, or you could not receive anything if you exceed the following income limits according to your age (for 2024):

-

- If you were younger than your Full Retirement Age during the entire year and earned more than $22,320, for every $2 you earn over this amount, $1 will be deducted from your benefit. For example, if you earned about $10,000 over this limit, about $5,000 will be deducted.

-

- If, instead, you are in the year in which you would reach your Full Retirement Age, in this case, for amounts that exceed the limit of $22,320, for every $3 you earn, $1 will be deducted from your benefit. For example, if you earned an additional $9,000 to this amount, they will reduce it by $3,000.

In this case, the most important thing is to understand well what is understood as income for this calculation of the limit. And the good news, is that only what comes directly from work or your income as a self-employed person is taken into account. Including bonuses, commissions and vacations.

Therefore, if you have income from your investment portfolio or because you receive income from renting real estate. Those amounts are not included in this calculation. Nor what comes from pensions or annuities.

In this case, it is important that you calculate your numbers well to avoid thinking that you are going to receive a larger amount by working and eventually your Social Security benefit will be affected and you did not know it.

2.- Will I have to pay taxes on the benefit I receive from Social Security?

There are two ways to see it. If the only income you are going to receive in your retirement is from the Social Security check. The good news is that you will not have to pay taxes on that amount.

But the big question is. Whether you will really be able to live on that amount alone, remembering that by 2024 the average monthly check is $1,907 according to Social Security. Which we know that in the vast majority of cases will not be enough for many people.

Now, if in your case you are going to have other income, then up to 85% of the benefit you receive from Social Security can be included in your taxes.

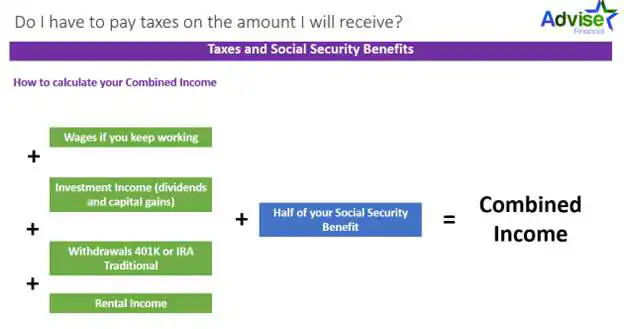

In order to determine whether in your case you will have to include it or not. You must know what the concept of Combined Income is for Social Security.

This income is used to determine the portion of your retirement benefit that will be included in your taxes.

Combined Income is calculated like this:

Wages + Investment Income + 401K, IRA or 403B + Rental Income + Half of your Social Security = Combined Income

If you file your taxes as a single taxpayer and your combined income is more than $25,000 for the year, that portion of your benefit that exceeds this amount will be taxed.

If, on the other hand, you file as a couple and your combined income is more than $32,000, the amount that exceeds this amount will be included in your tax return.

It is essential to know that the maximum amount of your benefit to your tax return is 85%. And you will pay income tax according to your tax bracket.

In these cases, many investors emphasize the empowering aspect of having savings accumulated in a ROTH IRA or ROTH 401K account, as it allows them to strategically manage their income and tax liabilities.

If the person has a traditional 401K and a ROTH account and is unsure which to withdraw from this year. They can find relief in the fact that withdrawing from their ROTH accounts can potentially reduce their tax burden, as this money is not added within the Combined Income formula.

This strategy can help ensure that the amount received for their Social Security does not have to pay taxes.

3.- Why is it crucial that you know what RMDs are if you have saved all your money in a 401 (k) or traditional IRA so far?

Saving in traditional retirement accounts has the great advantage of being tax-deferred.

This allows the money you contribute to your 401K or traditional IRA to be reduced from the income you produced that year.

If you invest it, you do not have to pay taxes on the growth in value of your investments. Or on the dividends or interest you earn.

But as we all know, if there is one thing that is certain in this life, it is that you will have to pay taxes. So Uncle Sam allows it to continue growing and tells you that when you withdraw it. That amount will be considered income and you will pay taxes.

Some might say: “Well, I should leave it there until I’m 100 and decide whether to take it out”.

Still, Uncle Sam is a little more impatient and tells you that in most cases, you’ll have to start taking money out when you’re 75, under a figure called Required Minimum Distributions or RMD.

You might think that while you have to start taking money out of your 401 (k) or traditional IRA, you should decide how much to take out. Maybe you think you’re going to take very little out so you don’t have to pay a lot in taxes. But it doesn’t work that way.

As its name suggests, the IRS has a table that determines the minimum amount you’ll be asked to take out every year. This could cause you to be forced to take out extremely high amounts, which will be counted as income.

For example, maybe you’re 78 years old and in a higher tax bracket than in the highest earning years of your working life.

Remember that your investment portfolio will most likely grow over the years due to the effect of reinvesting the money you produce. And may then become a significant investment when you are no longer so young.

But where Uncle Sam is your partner, and there is nothing wrong with that. Because only those who produce money are the ones who pay taxes.

This partnership ensures a fair distribution of taxes, providing a sense of security in your financial planning.

4. What is a ROTH Conversion, and why do many retirees need to know if it is a good idea?

After reading the previous question, you may be wondering if there is any way to optimize this situation so that my tax bill in the last years of my life is not so high.

We know that traditional retirement accounts offer us the option not to pay taxes today but to pay them tomorrow. On the other hand, the so-called ROTH accounts.

Whether as an IRA (Individual Retirement Account) or under a 401K, have the value offer of precisely the opposite: pay taxes today so that you do not pay them tomorrow.

That is where our suggestion will always be to have a bit of both types of accounts. Because we do not know if taxes in the future will be higher than now or will remain the same. And I am not saying if they will go down. Because the probability is very low.

But, what we do know is that if you have money in Traditional accounts and a ROTH, you will be able to have greater independence to choose whether to withdraw money. First from one or then from the other or, in a few years, withdraw from both.

Hence, the great popularity of ROTH accounts, but for example, in the case of ROTH IRAs, if you earn more than a certain amount, you cannot contribute money to them.

For 2024, this maximum amount would be $240,000 if you filed your taxes as a couple and $161,000 if you filed your taxes as an individual. Which means that people with high incomes cannot contribute.

On the other hand, the amount to contribute is relatively low when you have a high income. Because, in 2024, it will be about $7,000 a year, and if you are over 50 years old, you will be allowed to contribute about $1,000 more.

It is true that more 401K plans allow contributions under the ROTH modality every day. With an amount that can be $23,000 in 2024. We must remember that one in two people needs a retirement plan at work.

The thing is:

Is there a medicine to help improve this situation for those who have accumulated significant balances in their 401 (k) or traditional IRA accounts? .

One of the procedures we Financial Planners use the most is the ROTH Conversion.

ROTH Conversion strategies seek to optimize your different tax burdens throughout your retirement.

Because we all know that they work like a kind of “U.”

While you are working, you will be at the top of your tax burden. But when you stop working and have no income, you will be at the bottom.

And when you have to start the RMDs, you will be at the top again.

Therefore, the ROTH Conversion methodology seeks to withdraw money from your 401k, 403B, or Traditional IRA accounts. Because your tax burden is lower in those years, and the percentage of tax you pay is lower.

It is not as simple since the financial planners who provide hourly services create several scenarios to determine which one is best for you. Using sophisticated tax planning software.

But the great reality is:

That under hourly planning services, everyone can have access to a Planner to do these calculations for you.

In this way, two things can be achieved. When you reach 75 years of age, you no longer have to withdraw such a large amount when you get your RMDs. And even when you have left this world, your beneficiaries receive this money tax-free.

If you are going to carry out this ROTH Conversion process yourself. You must keep in mind two aspects that people sometimes might leave out:

-

- The 5-year rule. Where if you want to withdraw the money you converted, you might have to pay a 10% penalty. This period begins in the year you made the conversion and changes for each conversion.

-

- Be careful if the money you convert comes from a traditional IRA account. Because the pro-rata rule may apply. Which is a bit more complex; you will find more information here.

5- If you are retired and your investment portfolio goes down, is the only solution to cry and hope that it goes up one day?

Nobody likes to lose money.

And it is extremely stressful to see how the balance of your investment portfolio is going down. And even more so when there are such strong processes of falls as those experienced in the years 2007-2009, in 2020 with the pandemic. Or in 2022 when it was thought that a recession was coming and with all those inflationary processes.

Various studies show that seeing your portfolio fall hurts twice. As much as the joy you can feel when you see it rise.

But if we remember, that these processes are normal and on statistical average they occur almost every 5 years where your investments will suffer a drop in their balance. What we must do is always keep in mind that this money is not for the short term. But for your retirement and there history has shown us that portfolios tend to recover and normally grow.

So, periods of decline open up a great opportunity to apply a technique called Tax Loss Harvesting. Which involves selling those positions that have dropped substantially. In order to save that loss either to be used in the future when you have profits and can offset part or all of the taxes you would pay but with these losses.

For the application of this type of strategy, we also suggest hiring a Certified Financial Planner.

Usually those who provide Hourly Financial Planning services have a lot of experience with these cases. Since there are certain rules called Wash Sale Rule. Which although they are not so complex, they do have several details.

6.- Which account should I withdraw funds from Tax-deferred, Taxable, or Tax-Free?

When you are already retired and have followed our comments in this blog, you might have money accumulated in your 401K, 403B, or Traditional IRA accounts (called tax-deferred). You may also have money in a taxable investment account. And likely have a significant balance in ROTH accounts. Either IRA or 401K.

If this is your perfect scenario, you may have a straightforward question. Where should I withdraw money first, and from which accounts?

Although this analysis is more complex than those we will present below. We will give you a rule that you could follow:

It is better to leave the ROTH IRA account last. Because it is an account where the money you have grows without paying taxes. You will want to use it when you are older, in your last days. So that you do not have to pay taxes on the amount you withdraw.

The next question is. Whether it is better to withdraw from the taxable investment account first or start withdrawing from the tax-deferred account. Such as the 401 (k) or Traditional IRA.

The answer in this case is not so direct because:

While it is true, that as long as you do not withdraw money from the tax-deferred account, you will allow it to continue growing without having to pay taxe.

Enabling it to grow faster, we could say that it makes more sense.

In this case, to start with the taxable account because you are already paying taxes on it.

But in some cases, the fact that your tax-deferred account grows much faster could also cause you to have to pay more taxes. As we already saw when the RMDs arrived.

In conclusion.

We can see that tax issues can be addressed as long as we begin to plan in advance.

We will be able to take actions that allow you to optimize your taxes in retirement, thus helping you to have an independent retirement.

However, we also see that there are many pieces to consider. Which is why we always suggest looking for a specialist to help you review the different scenarios.

Hiring a Certified Financial Planner who provides hourly services would be particularly useful.

Author: Alonso Rodríguez Segarra CERTIFIED FINANCIAL PLANNER™